cap and trade vs carbon tax ontario

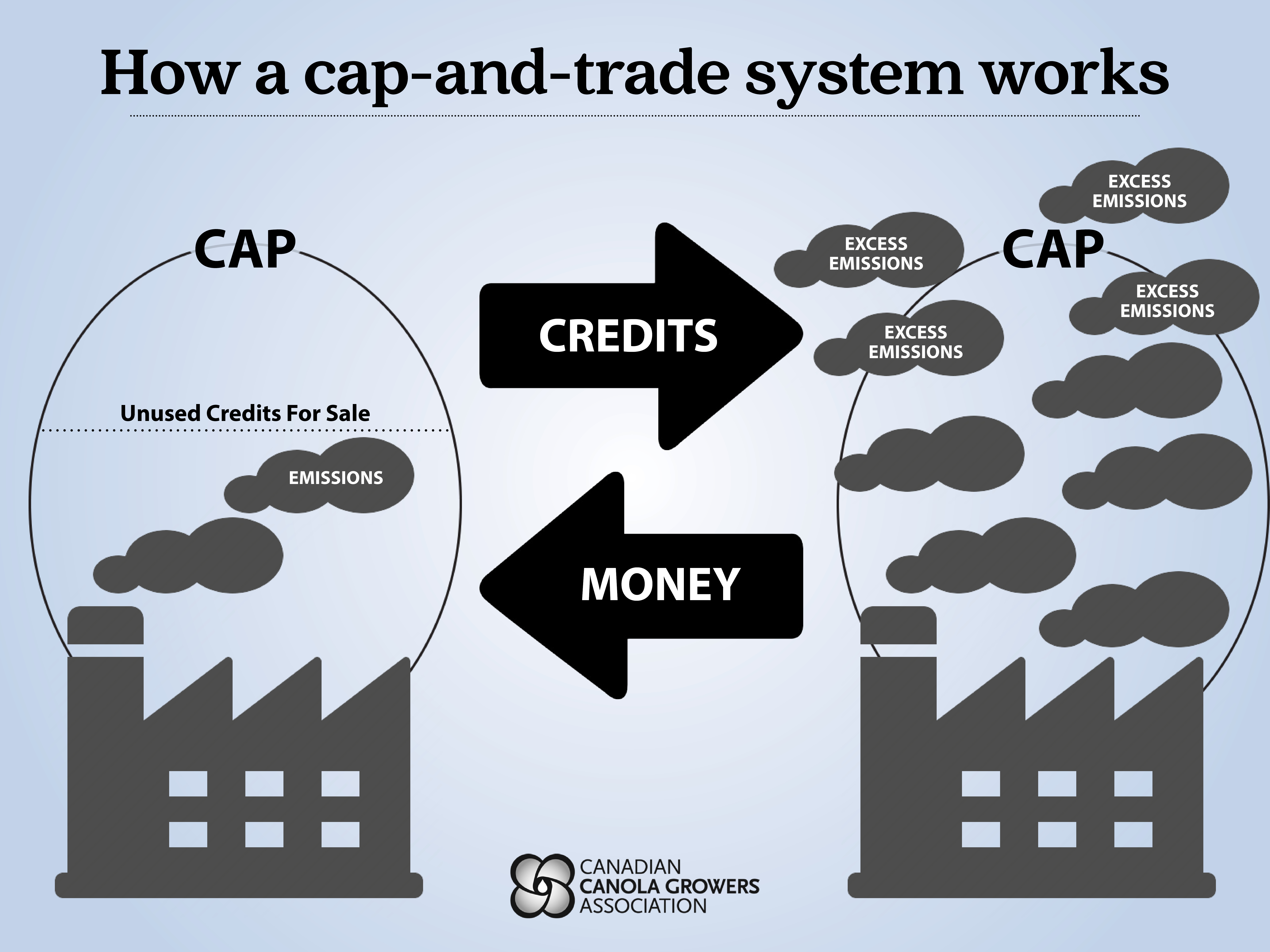

Cap-and-trade has one key environmental advantage over a carbon tax. More about this program.

What Is Carbon Pricing Canadian Canola Growers Association

Cap-and-trade CTV News Prime Minister Justin Trudeau announced a new nation-wide 10 per tonne carbon tax that will start in 2018 -- a price that will rise by 10 per year.

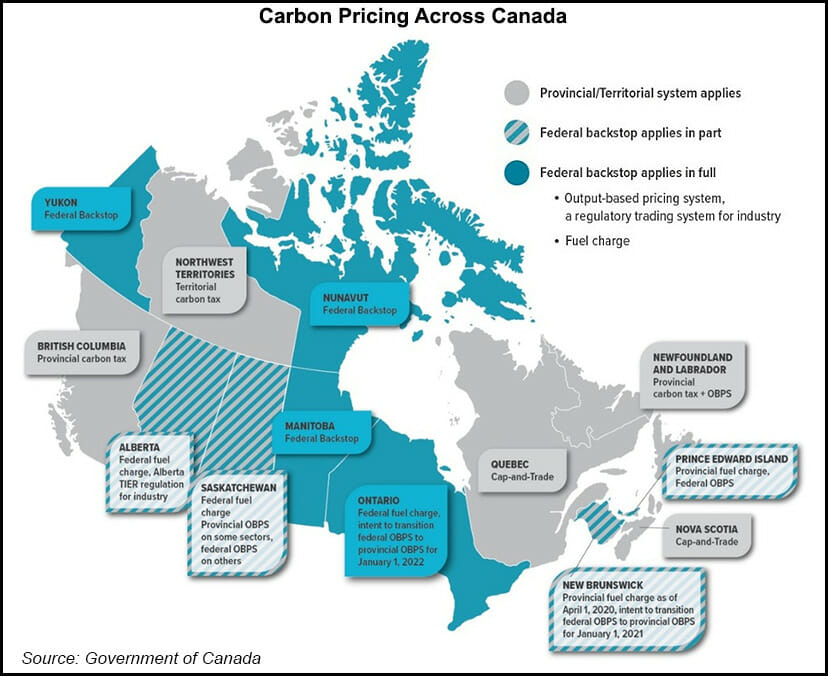

. Provincial carbon tax and OBPS. It provides more certainty about the amount of emissions reductions that will result and little certainty about the price of emissions which is set by the emissions trading market. The Cap-and-Trade Program is a key element of Californias strategy to reduce greenhouse gas emissions.

The Ontario cap-and-trade system aims to reduce emissions by 15 per cent of 1990 levels by the end of 2020 and reduce emissions by 37 per cent of 1990 levels by 2030. We have developed a plan to wind down the program. However the main purpose of this paper is to rebut his argument and to present why Cap-and-Trade is a better solution compare to other solution in controlling variables ensuring social justice and last expanding global regulation on carbon dioxide.

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. On July 3 2018 the Government of Ontario ended its climate plan including its cap-and-trade pollution pricing system. However in reality they differ in many ways.

Cap-and-trade involves setting an economy-wide emissions limit for those sectors under regulation and. For businesses Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances. The average Ontario family will receive 260 in annual savings thanks to the elimination of the cap-and-trade carbon tax.

Provincial fuel charge federal OBPS. Carbon pricing vs. Learn more about the program and what it means for you and the environment.

In certain idealized circumstances carbon taxes and cap-and-trade have exactly the same outcomes since they are both ways to price carbon. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences. April 9 2007 413 pm ET.

Cap and Trade in Action. In which how cap and trade can reduce. We have developed a plan to wind down the program.

Quebecs exemption from Trudeaus carbon tax will come at Ontarios expense While the Liberals say its essential to have a carbon tax that will rise to 170 a tonne by 2030. Critics blast government spending on court battle against federal carbon tax Ontarios cap-and-trade system aimed to lower greenhouse gas emissions by putting caps on the amount of pollution. This has resulted in a projected annual increase of emissions of approximately 48 million tonnes of carbon pollution in 2030 equivalent to the emissions from about 30 coal-fired electricity units.

With a carbon tax there is an immediate cost to. September 13th 2016 321 PM PDT. Today Minister of the Environment Conservation and Parks Rod Phillips announced details of legislation that would if passed formally end the cap-and-trade carbon tax era in Ontario.

Earlier this month Ontario Quebec and Mexico struck the first international climate change deal since the. Quebec also has a cap-and-trade system intended to reduce GHG emissions by 375 per cent of 1990 levels by 2030. Cap and trade.

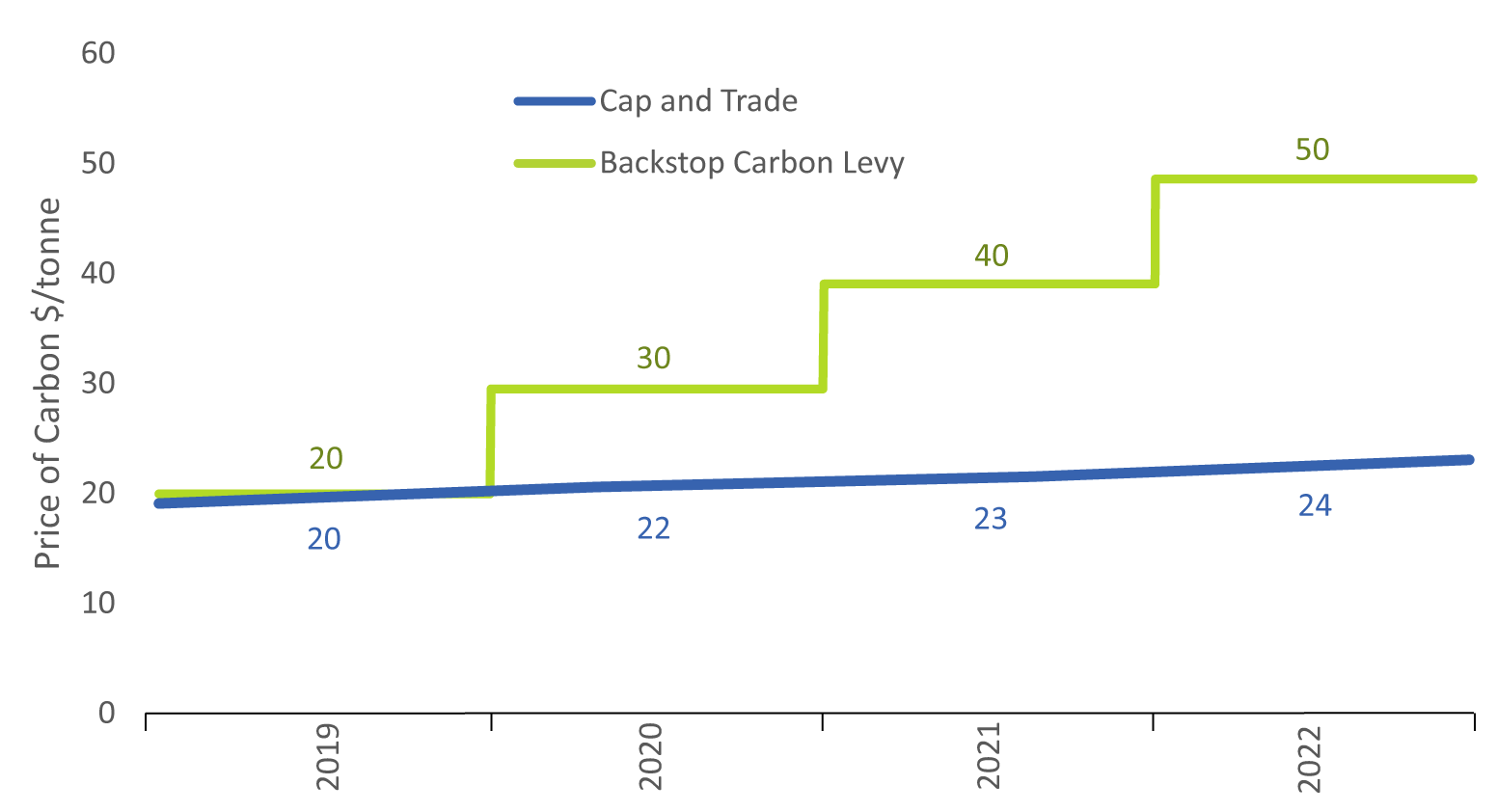

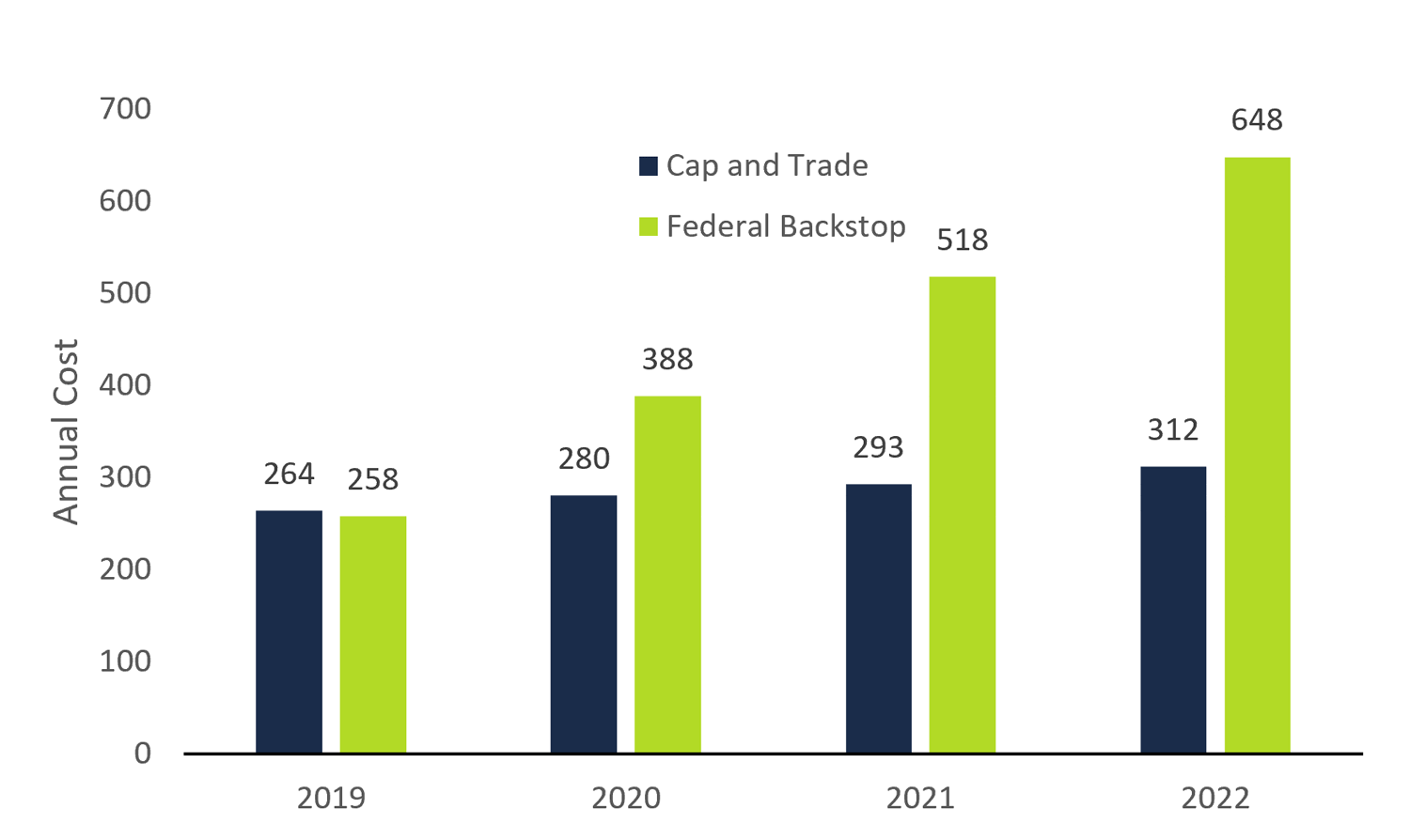

Cap-and-Trade Versus Carbon Tax. Argued that carbon tax is the less complex and better guarantee solution to carbon reduction. Weltman estimated while the annual cost of Trudeaus carbon tax to the typical Ontario household would be slightly less expensive than cap-and-trade in 2019 258 vs 264 by 2022 Trudeaus carbon.

Cap-and-Trade vs Carbon Tax. Cap and trade is a common term for a government regulatory program designed to limit or cap the total level of emissions of certain chemicals particularly carbon dioxide as. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions.

Federal fuel charge provincial OBPS as of January 1 2022. Provincial fuel charge provincial OBPS as of January 1 2021. No Clear Winner as Ontario Joins California.

Today cap and trade is used or being developed in all parts of the world. Cap-and-Trade vs Carbon Tax. It complements other measures to ensure that California cost-effectively meets its goals for greenhouse gas emissions reductions.

Learn the basics of cap and trade Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances. With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms. What you need to know about Ontarios carbon market using a cap and trade program including how it works and who is required to participate.

For example European countries have operated a cap-and-trade program since 2005. How Well Has It Worked. A carbon tax and cap-and-trade are opposite sides of the same coin.

A carbon tax forces companies to pay a fixed fee per ton of greenhouse gas emissions GHG. Several Chinese cities and provinces have had carbon caps since 2013 and the government is working toward a national program. Carbon Tax vs.

The discrepancy in the percentage increase in the carbon tax between 2021 and 2030 up by 325 per cent nationally and 298 per cent in BC and the gasoline fuel costs associated with the carbon tax up 350 per cent nationally and in Ontario and up 297 per cent in BC are due to differences in the effective carbon tax rates and gasoline fuel charges affected. The cap and trade program is a central part of Ontarios solution to fight climate change. In Quebec and Nova Scotia the governments cap the amount of emissions theyll allow each year then hold quarterly auctions so companies can buy emissions credits within that amount.

By Taras Berezowsky on April 15 2015. In 2017 Ontario will introduce a cap-and-trade system.

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

.png)

A Quick Guide To The Carbon Tax Rebate In Canada Clutch Blog

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Image Result For Carbon Price Climate Change Carbon Climates

Carbon Taxes Rebates Explained Province By Province

Gm Venture Picks Michigan For 3rd Us Based Ev Battery Plant Electric Boat General Motors Electric Cars

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Your Cheat Sheet To Carbon Pricing In Canada Delphi Group

Claims That Carbon Pricing Will Lead To Skyrocketing Price Increases Throughout The Economy Are Misplaced At Best And Misleading Carbon Economy Price Increase