how much does a property tax lawyer cost

100 low price guarantee. Ad New York and New Jersey Real Estate Lawyers.

For many other sorts of cases particularly tax issues an hourly fee is.

. Ad Legal Advice for any Area of Property Law Including Buying Selling Resolving Disputes. Ad Experienced Foreclosure Defense Attorneys Standing Up For Your Goals. The cost of hiring a lawyer for a property tax appeal will vary depending on the.

The majority of tax attorneys charge by the hour. Providing Quality Legal Services For Over 35 Years. The average hourly cost for the services of a lawyer ranges from 100 to 400.

Hourly fees for tax attorneys range from under 200 to over 450 per hour. 60 to 300 and up per hour depending on complexity. Free Case Review Begin Online.

Attorney Cost for a Commercial Real Estate Transaction. By Sonja Gosine Spokesperson at Hauseit December 28 2021. Fixed Fees Free Consultation.

For standard commercial closings. Call us today for a free consultation. Protect your most important investments for less.

Ad Based On Circumstances You May Already Qualify For Tax Relief. How Much Does a Tax Lawyer Cost. 100 low price guarantee.

Every tax attorney has a different rate but expect it to range from 200 to 400 per hour. Get a dedicated small business attorney on-demand and real legal work done at 50 off. Call Now for a Free Consultation.

Call Now for a Free Consultation. The average real estate. Compare - Message - Hire - Done.

Ad Thumbtack - Find a Trusted Tax Attorney in Minutes. You might also expect that lawyers charge higher rates as they gain more. Cost to hire a tax lawyer.

The general rule of thumb is that the bigger the law firm the higher costs. Ad New York and New Jersey Real Estate Lawyers. The general price ranges across South Carolina will not apply to every tax case.

Call us today for a free consultation. See If You Qualify For IRS Fresh Start Program. Plans start at only 2995month.

Ad The Experience You Need in a Nassau Estate Planning Attorney. Meeting Your Needs Is Our Top Focus. Well know that the costs with the property deed start right at the bank.

Heres a quick breakdown of the. Ad Weve Reimagined the Legal Experience From the Ground Up. To negotiate small agreements with the IRS you can pay from 700 to 1500.

Although each tax attorney will charge their own hourly rate you can expect to pay anywhere.

Farlap Associates Property Tax Appeal Savings Calculator

Criminal Defense Lawyer Cost 2020 Average Attorney Fees

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Criminal Defense Lawyer Cost 2020 Average Attorney Fees

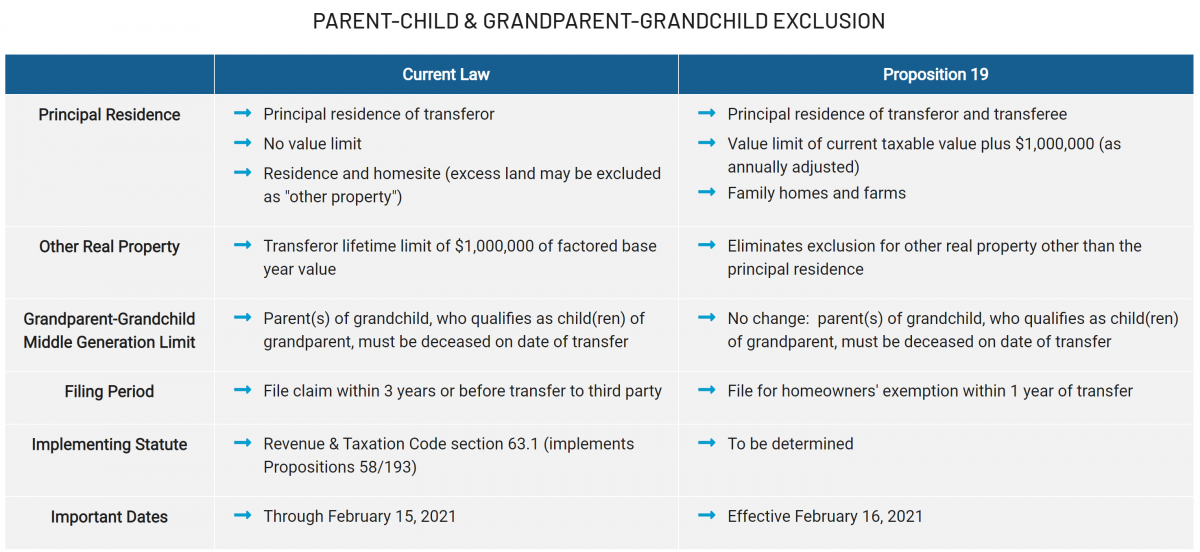

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Albany Golf Course Taxes Lawyer E Stewart Jones Hacker Murphy

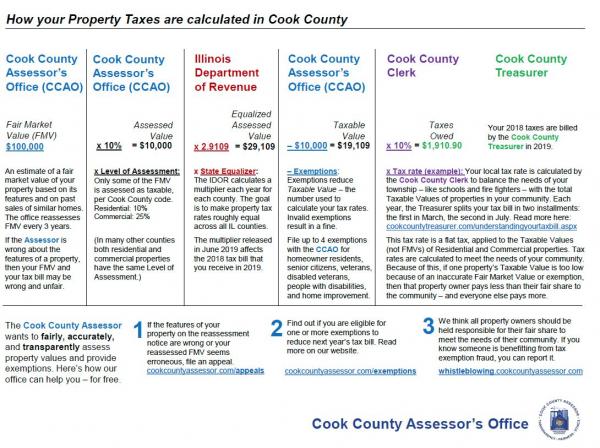

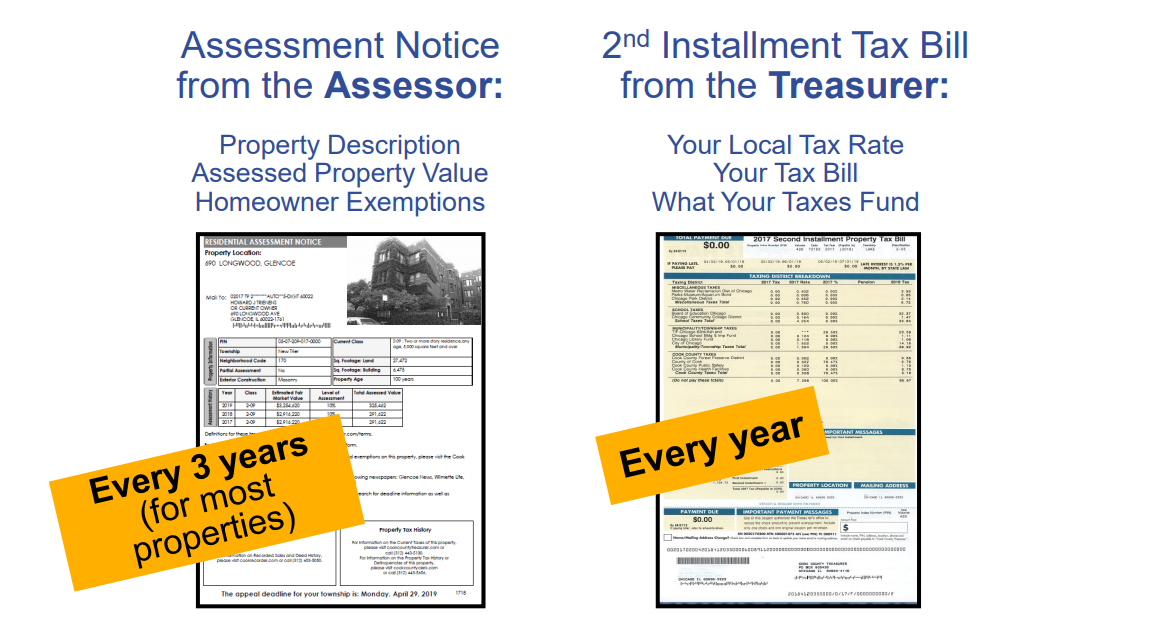

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Your Assessment Notice And Tax Bill Cook County Assessor S Office

The Tax Divide Chicago Tribune

Washington Dc Tax Lawyers Compare Top Rated Washington Dc Attorneys Justia

Mrsc Property Tax In Washington State

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

2022 Attorney Fees Average Hourly Rates Standard Costs

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

![]()

Understanding Property Taxes Your Must Know Guide On Rental Property Taxes Lowering Cost Tax Attorneys Mobile Home Taxes Appeal Process Deductions And What To Know When Selling A Property By Dawn J Jimison

When Are Property Taxes Due In California Sfvba Referral

8 Steps To Appeal Your Property Tax Bill Kiplinger

2022 Property Tax Bill Assistance Cook County Assessor S Office